Keen Venture Partners’ first close is anchored by EU capital and includes €40m Dutch pension fund allocation

Keen Venture Partners has closed its European Defence and Security Tech Fund at €150m, marking the largest dedicated defence venture capital vehicle raised in Europe and signalling growing institutional appetite for military technology investments.

The fund’s first close, announced Monday, was anchored by a €40m commitment from the European Investment Fund under its Defence Equity Facility — the EU’s programme to mobilise private capital for defence innovation.

The fund secured €40m from Pensioenfonds Metalektro (PME), one of the Netherlands’ largest pension schemes with approximately €70bn in assets. PME’s commitment represents a breakthrough in institutional acceptance of defence investments as European pension funds have historically avoided the sector due to ESG concerns and reputational risks, unlike US counterparts that have increasingly allocated capital to defence technology.

“Geopolitical realities are changing rapidly, and Europe needs to invest more in its security and resilience,” said Eric Uijen, chairman of PME’s executive board. “This investment supports the development of Europe’s high-tech defence sector and aligns with our mission to generate strong, long-term returns for our participants.”

EU catalyst model

The fund is the Defence Equity Facility’s first major deployment since its launch in January 2024. The EU programme, which combines €100m from the European Defence Fund with €75m from the European Investment Fund, aims to mobilise around €500m in private capital by providing anchor investments that confer institutional credibility and reduce perceived risk for other investors.

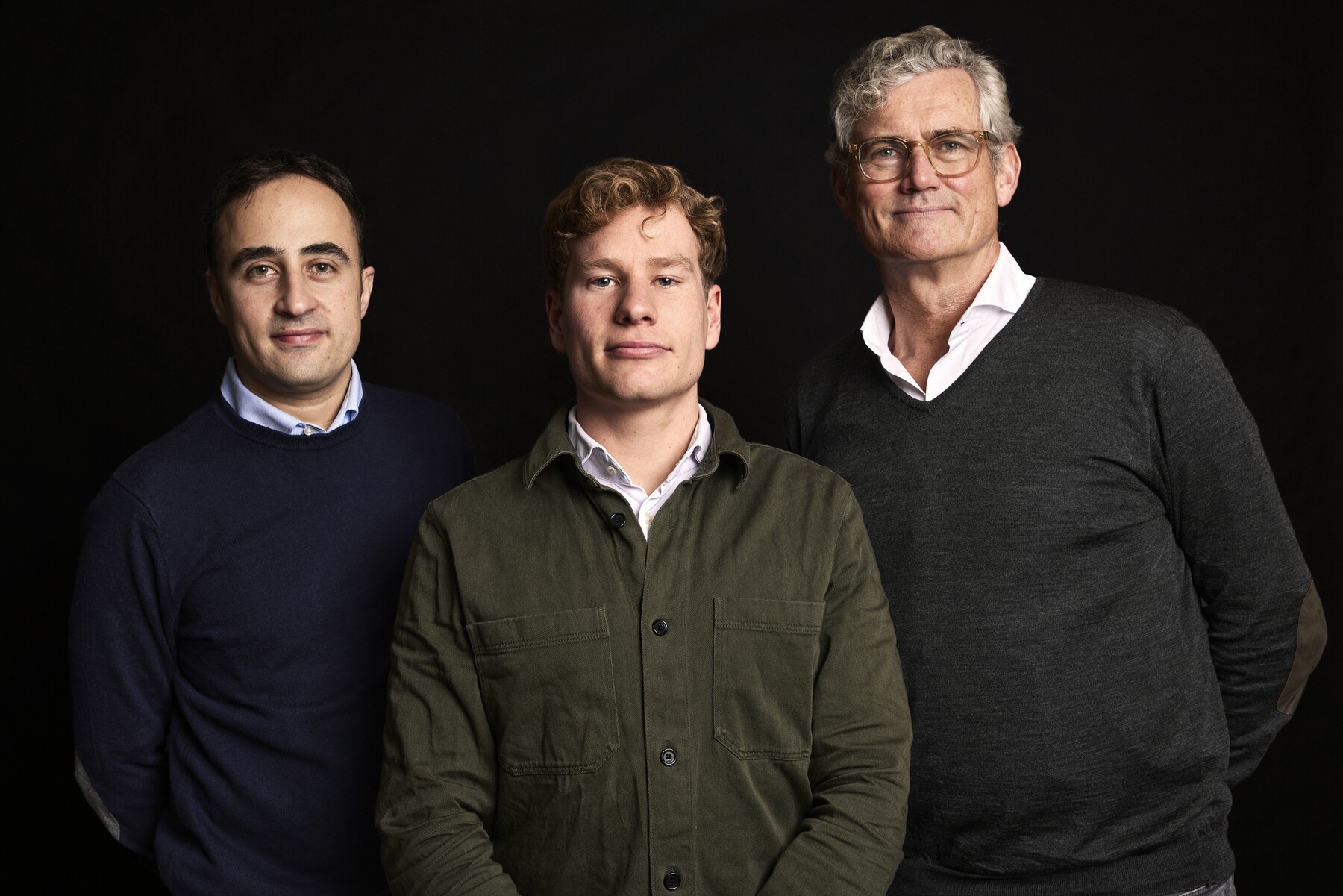

“Europe has the talent, technology and ambition. What was missing was capital and access to defence customers,”said Keen partners Alexander Ribbink and Giuseppe Lacerenza. “That is the gap this fund is closing.”

Beyond the EIF’s €40m, Keen attracted commitments from the Netherlands Organisation for Applied Scientific Research (TNO), the country’s largest independent research institute; ABN AMRO, the Netherlands’ third-largest bank with €385bn in assets; and Limburg Development and Investment Company (LIOF), the regional development agency for the southern province.

The fund is targeting a larger final close, though no target size or timeline has been disclosed.

Fund in deployment

Keen will deploy €1–10m tickets across more than 25 European companies, focusing on seed to Series B with particular emphasis on Series A rounds. The strategy covers dual-use and defence-first technologies including cybersecurity, autonomous systems, deterrence capabilities and space applications.

The firm tracks more than 800 European defence-tech companies through its proprietary database, which it claims is the largest in the region. The fund has already invested in cybersecurity firm EclecticIQ, threat-intelligence platform Intelic, and Perciv AI, which develops artificial-intelligence systems for military applications.

Investment geography spans the EU, UK, Norway and Turkey — reflecting the increasing involvement of NATO allies beyond the EU in Europe’s defence procurement ecosystem.

Shifting institutional stance

The fund’s first close accelerates a sharp shift in European defence-tech investment. According to data from Dealroom and the NATO Innovation Fund, European defence startups attracted €5bn in private capital in 2024 — a fivefold increase since 2019 — although American venture capital firms continue to dominate late-stage rounds.

Keen’s success in attracting European institutional capital, particularly pension-fund allocations, addresses a longstanding weakness in the continent’s defence-financing ecosystem. PME manages pensions for 333,000 participants in the metalworking and technology sectors and has historically prioritised sustainable-development investments. Its €40m allocation suggests institutional resistance to defence exposure may be easing as geopolitical risks reshape investment priorities.

Broader EIF programme

The Defence Equity Facility has also backed Sienna Hephaistos Private Investments with a €30m commitment in September 2025 — Europe’s first dedicated defence private-credit fund. Further EIF allocations are expected across venture capital, growth equity and debt to build a diversified portfolio of defence-focused managers.

Keen’s close shows that European private capital can scale into defence technology, albeit still heavily catalysed by EU anchor commitments. Whether other major European pension funds follow PME’s lead will determine how far Europe can finance its defence-innovation ecosystem independently of American capital.